"Biomimetics" is the emulation of elements of nature for the purpose of solving human problems. For instance velcro tape mimicing the tiny hooks on bur fruits, or Japan's Shinkansen bullet train, whose beaked-shaped nose got its inspiration from Kingfisher birds.

Innovation can often be described as taking something that works in one domain, and applying it within another domain. We're effectively transferring an existing solution pattern to new pastures, where "but for" become magical words: "like Uber, but for...".

I believe biology isn't the only fountain of innovative solutions. They're everywhere, and since this is a tech blog published by a bank, we'll flex this statement by using a tech pattern to solve a real-world bank problem. In short, welcome to an exercise in "innovation by pattern transfer"!

The problem

Banks have savings products and savings customers (i.e. people looking to invest their savings). The traditional way to connect products to customers is through old-fashioned "STP marketing" — segmentation, targeting, positioning — meaning that we position> each product so that they target a customer segment.

This approach becomes tricky for savings instruments. First, the savings customer base is as diverse as "anyone above 18 with a buck to spare". Second, the product array spans over thousands of stocks, mutual funds, certificates, bonds and more, each of them harder to comprehend than the other. Third, it's not as easy as "just picking one" – the products must be combined into portfolios in order to mitigate risk throughout the ups and downs of the market. And fourth, most people are passive investors, meaning that at the end of the day, they just want to set up a "healthy", long-term low-risk portfolio that gives them a return and go on with their lives.

And by that, it's time for our problem statement: How can we connect combinations of thousands of products to a diverse audience who are not really interested? In other words, is there a pattern that connects a number of consumers to a number of producers, so that each consumer can consume the product in an individual, "appealing" way that builds interest, commitment and retention?

The solution

We've done the hard part – phrasing the problem. Now it's time for pattern transfer, and it so happens that the holy discipline of Enterprise Architecture has just the pattern for us. It's called The Mapper Pattern. Martin Fowler describes this pattern as an object that sets up a communication between two independent objects, for instance between service consumers in one network protocol and service producers in another network protocol. (Don't worry, things will clear in a while.)

The analogy goes: this pattern allows us to segment customers any way we want, bundle stocks any way we want, and connect them with an individual touch. The "individual touch" consists of interest, commitment and retention.

If we could transfer this pattern to the domain of savings, we would be looking at an "object" that "sets up communication between" any customer segment (the consumers) and any group of savings instruments (the providers). The "object" would do it in a way that builds interest, commitment and retention.

For the purpose of demonstration, let us define the segment of "socially aware, interested in impact investments". Then we'll connect those to a group of micro-investment instruments targeting the African continent, and that connecting “object” in the middle that builds interest, commitment and retention, becomes something that resembles a game board.

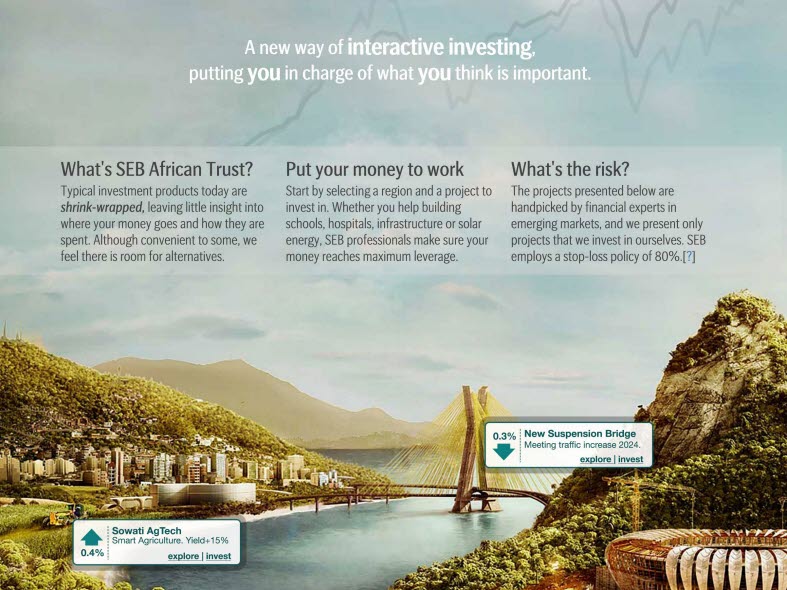

Behold, the African Trust:

"Biomimetics" is the emulation of elements of nature for the purpose of solving human problems. For instance velcro tape mimicing the tiny hooks on bur fruits, or Japan's Shinkansen bullet train, whose beaked-shaped nose got its inspiration from Kingfisher birds.

Innovation can often be described as taking something that works in one domain, and applying it within another domain. We're effectively transferring an existing solution pattern to new pastures, where "but for" become magical words: "like Uber, but for...".

I believe biology isn't the only fountain of innovative solutions. They're everywhere, and since this is a tech blog published by a bank, we'll flex this statement by using a tech pattern to solve a real-world bank problem. In short, welcome to an exercise in "innovation by pattern transfer"!

The problem

Banks have savings products and savings customers (i.e. people looking to invest their savings). The traditional way to connect products to customers is through old-fashioned "STP marketing" — segmentation, targeting, positioning — meaning that we position> each product so that they target a customer segment.

This approach becomes tricky for savings instruments. First, the savings customer base is as diverse as "anyone above 18 with a buck to spare". Second, the product array spans over thousands of stocks, mutual funds, certificates, bonds and more, each of them harder to comprehend than the other. Third, it's not as easy as "just picking one" – the products must be combined into portfolios in order to mitigate risk throughout the ups and downs of the market. And fourth, most people are passive investors, meaning that at the end of the day, they just want to set up a "healthy", long-term low-risk portfolio that gives them a return and go on with their lives.

And by that, it's time for our problem statement: How can we connect combinations of thousands of products to a diverse audience who are not really interested? In other words, is there a pattern that connects a number of consumers to a number of producers, so that each consumer can consume the product in an individual, "appealing" way that builds interest, commitment and retention?

The solution

We've done the hard part – phrasing the problem. Now it's time for pattern transfer, and it so happens that the holy discipline of Enterprise Architecture has just the pattern for us. It's called The Mapper Pattern. Martin Fowler describes this pattern as an object that sets up a communication between two independent objects, for instance between service consumers in one network protocol and service producers in another network protocol. (Don't worry, things will clear in a while.)

The analogy goes: this pattern allows us to segment customers any way we want, bundle stocks any way we want, and connect them with an individual touch. The "individual touch" consists of interest, commitment and retention.

If we could transfer this pattern to the domain of savings, we would be looking at an "object" that "sets up communication between" any customer segment (the consumers) and any group of savings instruments (the providers). The "object" would do it in a way that builds interest, commitment and retention.

For the purpose of demonstration, let us define the segment of "socially aware, interested in impact investments". Then we'll connect those to a group of micro-investment instruments targeting the African continent, and that connecting “object” in the middle that builds interest, commitment and retention, becomes something that resembles a game board.

Behold, the African Trust:

What you're looking at is basically a gameboard where you get to create and grow your portfolio by investing into different micro projects. The projects are real projects, only presented in a context that makes sense and in a way that builds interest in this particular customer segment. By exploring the map, investors can immerse themselves into each project, see clips of the project leader presenting milestones and goals, and last but not least, invest.

In order to also build retention it's crucial that the map is “actual”, continuously evolving, that its graphics gets daily, albeit tiny, updates that reflect the progress of each project.

The example above is just one way of presenting these particular instruments in a way that appeals to this particular customer segment. Another segment might have interest in the same instruments, but would want the map to look different, and yet another segment would rather immerse themselves into wind farms on the Kentish flats, or a strategy gameboard of Europe’s 20 biggest industry companies. The gameboard becomes the investor’s centre of gravity — a board that can also visualise the risk, diversity and sustainability of current investments.

To sum things up, we just used software architecture to solve a marketing and product distribution problem. These solution patterns can be found in virtually any discipline, and patterns also have a tendency of repeating themselves across disciplines. In fact, I would argue that the hard part isn’t finding the solution pattern, it’s phrasing the problem in a way for pattern matching to make sense.