Transforming Banking with Insights

1-0 1-0 Insights here, your one and only source into the scandalous revolution of reshaping banking as we know it.

Whisper it through the corridors at SEB: Embedded is turning the banking game on its head. With their Insights slicing through the traditional way of banking, they're crafting a Banking as a Service (BaaS) so bespoke, it's like your personal shopper for banking solutions. Tailoring every experience, they're not just enhancing offerings; they're redefining customer affairs with their banks.

This isn't just banking, fellow bankers, it's banking with a velvet rope and a VIP list, ensuring everything from compliance to security is as tight as the guest list at a B-list celebrity's birthday bash.

What exactly is Banking as a Service, you might ask?

In the ever-evolving world of financial technology, SEB has embarked on a transformative journey, introducing a new division dedicated to revolutionizing how banking services are integrated into our daily lives. Named SEB Embedded, this initiative builds on the foundation laid by SEBx, marking a shift towards bringing banking to where it's needed.

Banking as a Service represents a shift in the traditional banking model, enabling companies without banking licenses to offer financial products directly to their customers. Imagine a scenario where a company's relationship with its customers doesn't end at the point of payment, loan, or financial service interaction. With BaaS, businesses can now seamlessly integrate banking services into their offerings, ensuring a complete and enhanced customer journey. This means a smoother, more cohesive experience for the end-user, facilitated by SEB Embedded’s unique business-to-business-to-consumer (B2B2C) model. Our BaaS platform delivers backend banking functionality to distributors via APIs, embodying a new approach for SEB.

Empowering businesses with the gossip inside, we call it: Insights as a service

Deep within the hallowed halls of SEB Embedded lies the Insights division, a trove of secrets empowering businesses with the gossip on how their new banking products are performing. But fellow bankers, it's not just gossip; it's Insights as a Service. From expanding territories to diversifying your portfolio, our analytics are the whispers behind every major business move, ensuring your offerings are not just seen but desired.

Our goal is to empower businesses with data-driven insights on the performance of their new banking products. This includes analyses on utilization and customer journeys, providing a comprehensive overview of how these services impact the broader business strategy.

Insights as a Service, as we call it, goes beyond mere data reporting. It encompasses a suite of services designed to align with our clients' strategic objectives, from market expansion to service diversification. Our analytics enable informed decision-making, ensuring our partners can tailor their offerings to better meet customer needs.

Tailored analytics for every need

Whether it's compliance you crave or a dive into the analytics, we maintain the sanctity of your secrets while equipping you with the arsenal to charm and conquer.

Understanding that our clients come with diverse data capabilities and analytical needs, SEB Embedded ensures flexibility in how insights are packaged and delivered. Regardless of the specific requirements, our products always prioritize built-in compliance, adherence to financial regulations, and the maintenance of stringent security standards. These efforts guarantee that our partners can leverage insights for strategic planning, customer behaviour analysis, and service optimization, all while ensuring regulatory compliance and data integrity preferences.

A tale of data and analytics, empowering the BaaS scene

At the heart of SEB Embedded's strategy lies a tale as old as our time (2023): data and analytics. But with our twist, it's not just about offering insights; it's all about crafting experiences so personal, they feel whispered.

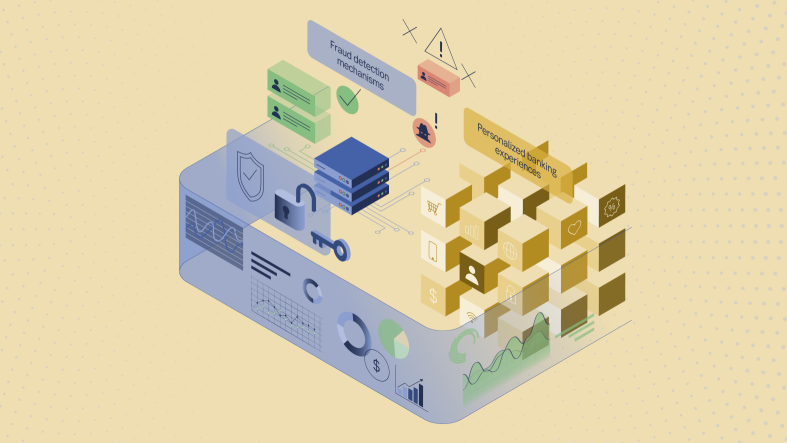

By applying detailed insights, we offer external insights products to enhance personalized banking experiences. Aside from that we also provide internal services with insights to enhance our banking products such as developing sophisticated fraud detection mechanisms. This not only improves the security and relevance of banking services but also fosters a deeper connection between our clients and their customers.

And who am I? Meet insights

A mosaic of experiences, from the basketball courts to the karaoke stage, from the tech labs to the hustle of start-ups, I've danced through life's roles, always returning to my first love: "as a service". Though the term may echo 2017, in the hallowed year of 2024 - it is the heartbeat of our revolution?

So, here's to the banking world, where I will be your guide through the SEB Embedded saga, promising you a story not just of banking, but a transformation full of gossip or how we call it, simply: Insights.

Insights @SEB Embedded